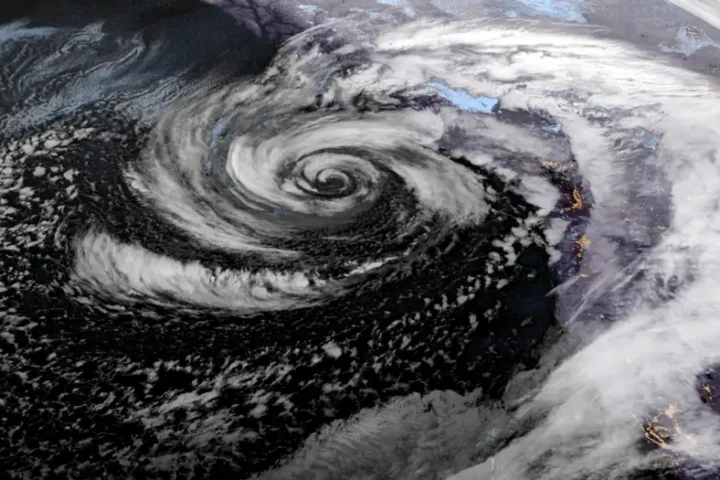

US-based social media platform Reddit makes its debut on the New York stock market exchange, after the first big tech IPO in years.

American social media company Redditmakes its trading debut on the New York Stock Exchange on Thursday after its initial public offering (IPO) saw strong demand from investors.

Reddit’s debut comes at a time when the US technology sector has seen a substantial slowdown in IPOs since the US Federal Reserve started hiking interest rates. The last big social media company to go public on exchanges was Pinterest in 2019.

The company’s IPO was priced at $34 per share for 22 million shares, which values the company at around $6.4 billion (roughly €5.8 billion), it said in a statement on Wednesday. That is substantially lower than the $10 billion valuation it saw in a private fundraising round in 2021.

Reddit had first filed for an IPO in 2021 when the tech sector was enjoying a Covid-linked boost. However, its efforts stalled as the boom started to subside.

The company, which will trade under the RDDT ticker on exchanges, has never turned a profit since its inception in 2005 and has cumulative losses of $717 million.

The parent company of publishing house Conde Nast and OpenAI CEO Sam Altman are some of its major shareholders.

Loyal but errant user base

Reddit has remained relatively small when compared to other social media giants. For example, Meta’s Facebook, which was formed only 18 months before Reddit, boasts a market value of more than $1.2 trillion.

Reddit’s platform, unlike Facebook or X, is divided into thousands of separate chat rooms where its 73 million average daily users and 267 million monthly users discuss topics ranging from memes, recommendations, news topics and even stock market investments.

Its construct makes posts more unlikely to go viral but it’s also stayed closer to its original goal of being a user-driven forum for sharing and drawing attention to interesting information online.

Moreover, Reddit relies on an army of volunteers to moderate the chat groups which consist of loyal but often unpredictable users making it more difficult to rope in advertisers.

The platform’s relaxed approach to content moderation is another sticking point.

In its hunt for new revenue sources, Reddit in February revealed a $66 million contract to provide artificial intelligence training data to Alphabet’s Google.

However, last week the company said the US Federal Trade Commission was conducting an inquiry focused on the company’s sale, licensing, and sharing of user-generated content with third parties to train AI models.