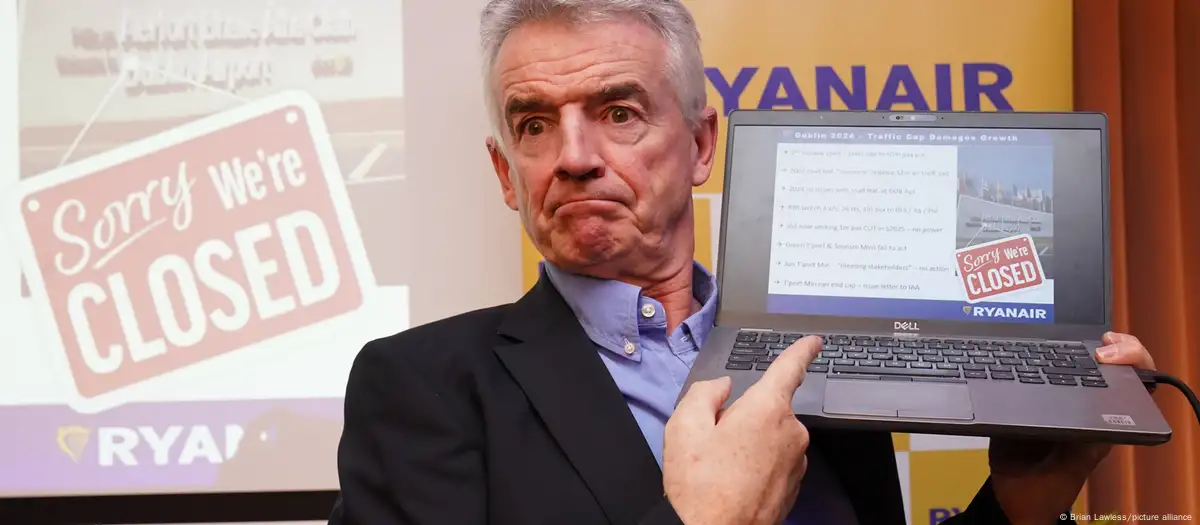

Low-cost airline Ryanair is stopping all flights to three minor German airports and also cutting its operations in Hamburg by more than half. It blamed the government in Berlin for high taxes and airport fees.

Irish low-cost airline Ryanair on Thursday announced major cutbacks to its services in Germany for the summer of 2025.

The airline will no longer fly to airports in Dortmund, Dresden and Leipzig at all. In Hamburg, summer flight totals will be reduced by 60% compared to the previous year. And, as already announced in August, 20% fewer flights will come and go from Berlin as well.

The company estimated that these cuts would amount to 1.8 million fewer seats for passengers on its planes in 2022, 22 fewer flight routes, and an overall dip of 12% capacity in Germany.

How did Ryanair explain the move?

Eddie Wilson, the CEO of Ryanair DAC, the group’s main and oldest airline, attributed the decision to costs that he said were too high in Germany, and to Berlin’s support of the “high-price monopoly” enjoyed by flag carrier Lufthansa.

“Germany has only recovered 82% of its air traffic totals from before COVID, making it by far the worst performer in the European air travel market,” Wilson said.

“As a result of these high state taxes and fees (the highest in Europe) as well as the high-price monopoly of Lufthansa, German citizens and visitors are now paying the highest flight prices in Europe,” Wilson said.

Ryanair often criticizes flag carriers like Lufthansa, which it noted in Thursday’s press release “was saved with €6 billion” during the COVID pandemic by the German government, and the state support several of them received during the pandemic.

Ryanair said it did not anticipate job losses at the company, despite the reduced flight plan, though it did predict knock-on effects for other workers and industries like taxi drivers and the hospitality sector.

Ryanair had complained about the situation, and threatened to vote with its feet, to German Transport Minister Volker Wissing in August.

The airline drives a notoriously hard bargain over extra costs like airport transit fees, seeking to keep operating costs low to go with its ticket prices, which is why its planes are often harder to find at the busiest European airports that tend to charge more.

WIlson said that Ryanair had presented a “7-year growth plan” to the German government in August, but had heard nothing back from the federal or state governments.

“The refusal to promote growth at German airports is shortsighted, because Ryanair is prepared to expand considerably in Germany,” Wilson said. “But the rising air travel tax, security and airport fees are leading to these capacities being relocated to other EU states.”

The air travel tax was increased by the German government in May, it lies between roughly €15 and €70 per ticket, primarily depending on how long-distance a flight is, with airlines typically passing costs on to consumers.

German BDF says Ryanair reduction no surprise

Germany’s BDF federation of airlines has also complained that airport costs in the country are among the highest in Europe.

It responded on Thursday by saying Ryanair’s move was both predictable, and potentially even the first of many such headlines.

“This was a withdrawal with advanced warning, and it shows the negative dynamic that Germany currently finds itself in as an air travel location,” BDF director Michael Engel said.

The BDF said it expected more bad news of this type, particularly regarding Hamburg. At that hub, the operator is planning to raise its fees in 2025.

Another industry lobby group, the ADV in Berlin, warned in a statement that Ryanair’s move demonstrated how “we are no longer competitive.”